BP offered its subsequent annual forecast for the event of the world vitality. The peculiarity of Energy Outlook 2020 is that this time analysts of the British vitality firm tried to look into the long run not twenty, however thirty years without delay – till 2050.

The Russian media paid lots of consideration to this publication, however targeted primarily on the worldwide oil market, and plenty of articles in a single type or one other adopted the headline of the TASS report: “BP predicts the tip of the period of development in oil demand.” DW determined to speak about what modifications BP specialists anticipate on the EU vitality market and analyze the doable penalties of the three situations offered for Russia, the primary provider of oil, fuel and coal to the EU.

The struggle in opposition to CO2 emissions will basically change the worldwide market

BP Energy Outlook 2020 assumes that world vitality demand will enhance, primarily as a result of development of prosperity in creating international locations and the additional enhance within the function of electrical energy. At the identical time, within the European Union, in response to all three situations, vitality consumption will lower, and considerably. The authors clarify this, initially, by the formidable plans of the EU to enhance the vitality effectivity of buildings and industrial enterprises. This runs counter to numerous Russian forecasts of development in demand for vitality assets in Europe, which, specifically, justify the necessity for the Nord Stream 2 and Turkish Stream fuel pipelines.

The world has taken a course to scale back CO2 emissions into the environment, BP specialists haven’t any doubts about this, and due to this fact they’re ready for basic modifications within the world vitality system. The function of fossil hydrocarbon vitality carriers within the strategy of decarbonization all through the world will decline in favor of renewable vitality sources (RES). It is that this phase that can develop on the quickest tempo on the planet within the subsequent 30 years.

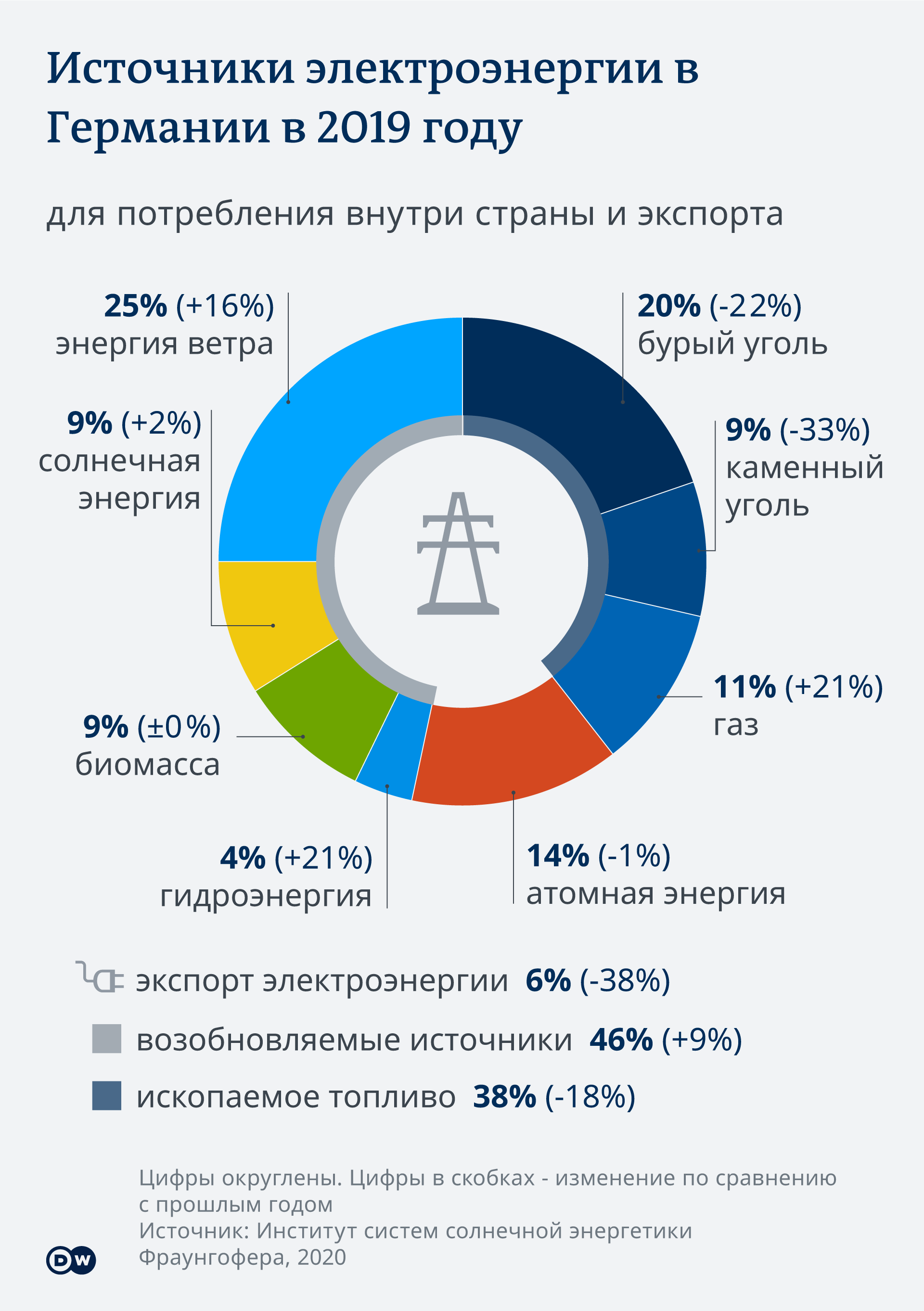

In all three situations, the share of RES within the construction of main vitality consumption will invariably be the very best on the planet within the European Union. This share might attain 39%, 58% or 63% by 2050. Wind vitality might be of the best significance within the EU, in response to all three situations. The two situations assume comparable development charges for photo voltaic vitality.

Oil demand in Europe won’t return to the earlier stage

In the worldwide oil market, BP predicts not a lot “the tip of the period of development in oil demand,” as TASS put it, however “a drop in oil demand within the subsequent 30 years.” The scale and pace of this decline will largely depend upon the tempo of vitality effectivity enhancements in highway transport and its electrification, in different phrases, on the transition to electrical automobiles. Under all three situations, oil use within the transport sector will peak in mid-2020.

BP emblem underlines the corporate’s dedication to inexperienced vitality

However, the important thing function within the destiny of oil is to be performed by the states of the planet. The extra they stimulate the discount of CO2 emissions into the environment, the sooner the worth of this vitality service will fall. BP, which is more and more remodeling from an oil firm into an vitality agency with an emphasis on renewable vitality, believes that world oil demand might fall by 10%, 55% and even 80% over the subsequent three a long time. The two situations assume that demand won’t ever return to the extent it reached in 2019 after the COVID-19 pandemic.

If we speak solely concerning the European Union, then all three situations are primarily based on the truth that the height of oil consumption within the EU has already handed. It ought to be borne in thoughts that, for instance, in Germany, a few quarter of crude oil imports are supplied by the Russian state-owned firm Rosneft, which additionally owns stakes in three giant oil refineries within the FRG.

Export of Russian coal to Europe: no future

BP specialists have little question that coal has no future within the European vitality sector, particularly since an increasing number of international locations are setting a particular finish date for its use. According to 2 situations, the share of the nook in electrical energy era within the EU might be 0% in 2050, one situation assumes 5%. But till this 12 months, about half of Russian coal exports went to the European path, and in ports on the Baltic and close to Murmansk, capacities for its cargo had been expanded.

Coal-fired energy vegetation haven’t any massive future: they pollute the atmosphere an excessive amount of

At the identical time, BP predicts the rising function of environmentally pleasant hydrogen within the world and European vitality sector. In three a long time, the European Union will occupy the third place among the many largest world customers of H2 after China and the United States, the EU’s share in world demand might attain 9-16%, in response to Energy Outlook 2020. Germany is now accelerating the event of the hydrogen financial system, and a variety of German specialists consider that Russia might turn into an vital provider of hydrogen to the Federal Republic of Germany and the EU as a complete, which might permit the Russian Federation to a minimum of partially offset the losses from the discount in oil and coal exports.

Liquefied Natural Gas: Best Prospects in Asia

Of all of the fossil fuels, pure fuel has the most effective probabilities within the world market, in response to BP’s long-term forecast. In one situation, which doesn’t suggest the compelled decarbonization of the world vitality, world fuel demand will develop by a few third in comparison with the extent of 2018, within the different it is going to stay at this stage, within the third, primarily based on essentially the most drastic discount in CO2 emissions, it is going to lower by a few third.

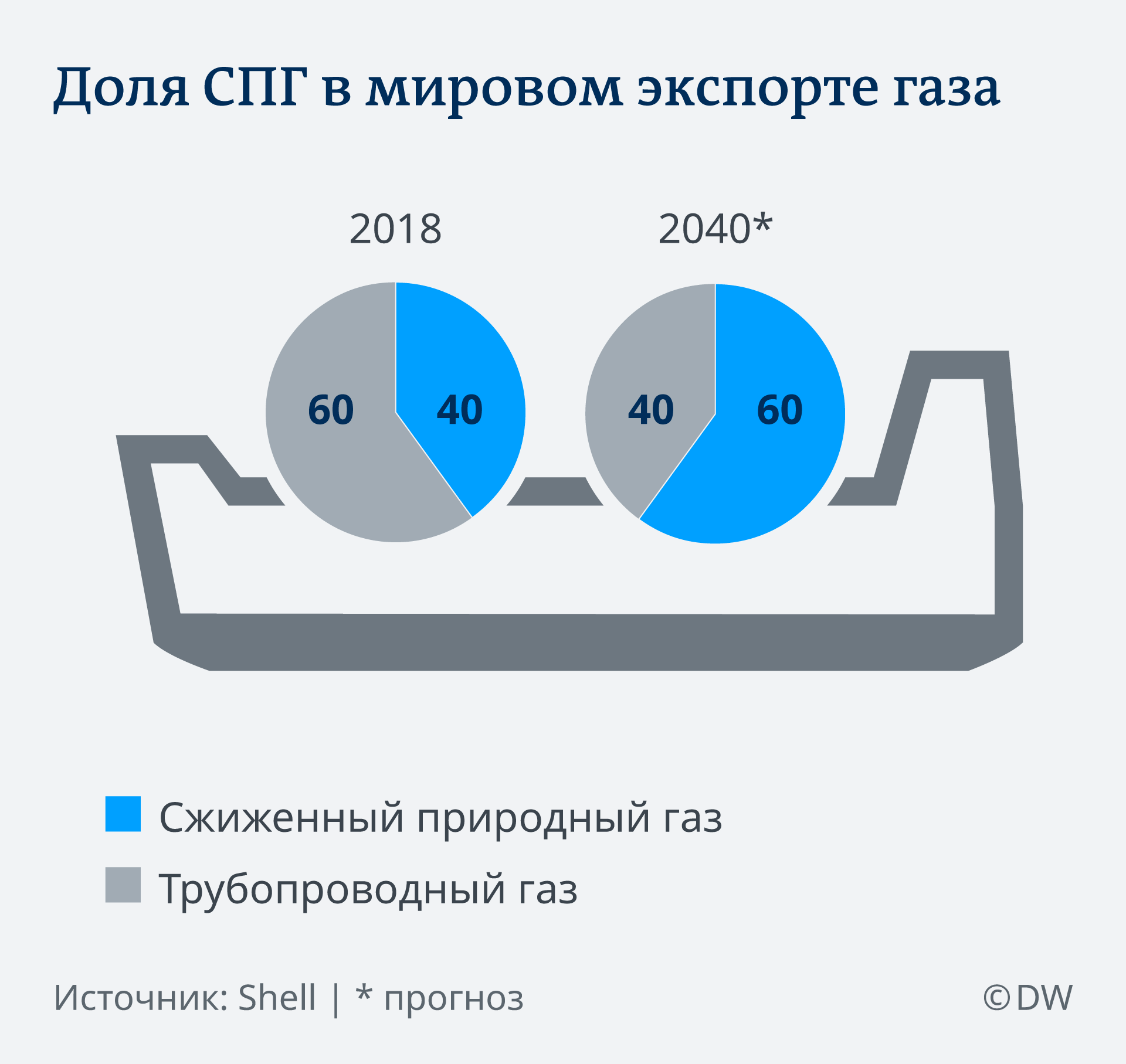

True, demand will more and more use liquefied pure fuel (LNG), and its consumption will develop primarily in Asia, the place will probably be changed by coal, BP analysts say. From this it may be concluded that within the Russian gasoline and vitality advanced below any situation, the most effective export prospects within the medium time period are the LNG producers – Novatek and Gazprom, in addition to Rosneft.

Gazprom’s pipeline provides to the European Union are nonetheless fairly secure, however apparently nothing extra. If something, the European fuel market and its largest provider, Russia, have obtained surprisingly little consideration in Energy Outlook 2020.

See additionally: